What is impact analysis?

Impact analysis: A quick intro

Impact analysis. It's a term that frequently crops up in boardroom discussions and strategy meetings. But what does it really mean? It's a tool for understanding the consequences of a change within a specific environment or domain. As businesses and organizations navigate the unpredictable waters of everyday industries, understanding the implications of decisions becomes paramount.

Origins and historical context of impact analysis

Impact analysis didn't suddenly spring into existence. Its roots lie in various disciplines, including economics, environmental science, and business management. The 20th century saw an increased understanding of systems thinking, acknowledging variables' interconnectedness. As this understanding grew, so did the realization that a change in one part of a system could have ripple effects elsewhere. Hence, the formalized process of studying these effects became called impact analysis.

Purpose of impact analysis

At its core, impact analysis aims to achieve four main goals:

Risk identification and mitigation: Every decision in business or technology carries risks. Impact analysis helps forecast these risks, allowing stakeholders to address them proactively.

Efficient allocation of resources: By understanding potential impacts, organizations can allocate resources wisely, ensuring maximum returns and avoiding wastage.

Enhancing stakeholder communication and involvement: It's not enough to make a decision; you must communicate it. Impact analysis helps streamline stakeholder interactions, ensuring all parties are well-informed.

Supporting decision-making: Armed with a comprehensive understanding of potential consequences, decision-makers can opt for strategies that yield the best outcomes.

Components of impact analysis

Impact analysis involves a multi-layered approach. Understanding its components provides a clear roadmap to navigate the intricacies of decision-making.

Problem/Change Identification: Every impact analysis begins with understanding the root of the change. Whether a business is considering a merger or implementing a new technology, pinpointing the nature and scope of the change is paramount. This phase is about diagnosing the need: why is the change being proposed? Is it driven by external market pressures, internal innovations, or shifts in global dynamics?

Stakeholder Identification: Stakeholders are not just top-tier executives or direct consumers; they can span a broad spectrum, from local communities to international partners. Identifying these groups is pivotal because each may perceive and experience the impacts differently. In business, overlooking a key stakeholder group can result in reputational damage or missed opportunities.

Assessment of Impacts: The rubber meets the road here. Analysts dive deep to predict potential consequences. They look at immediate short-term impacts, long-term repercussions, and the domino effects that might cascade across different business sectors. This component is the heart of the process, demanding rigorous research, forecasting, and scenario modeling.

Types of impact analysis

Given the versatility of impact analysis, its application in diverse business sectors offers varied insights:

Environmental Impact Analysis (EIA): EIA is indispensable for industries like energy, construction, and agriculture. It evaluates how business projects affect local ecosystems, air quality, and water resources. Given the rising global emphasis on sustainability, ensuring eco-compliance isn’t just about regulation but social responsibility and branding.

Economic Impact Analysis: Retail, manufacturing, and tourism sectors often use this analysis. It dives into how business activities affect local and national economies. Aspects like job creation, GDP contributions, and local market price fluctuations fall under its purview.

Business Impact Analysis (BIA): Paramount for sectors like finance, healthcare, and IT, BIA determines how disruptions could influence operational efficiency. For instance, if a bank's digital infrastructure faces a glitch, the repercussions aren't just technical—they could undermine customer trust.

Technology/IT Impact Analysis: Tech giants, software companies, and digital startups frequently employ this. Understanding tech-related impacts is non-negotiable in an era where a minor app update can drastically change user engagement metrics.

Tools and techniques

The world of Impact Analysis is armed with a suite of tools and techniques to ensure precision:

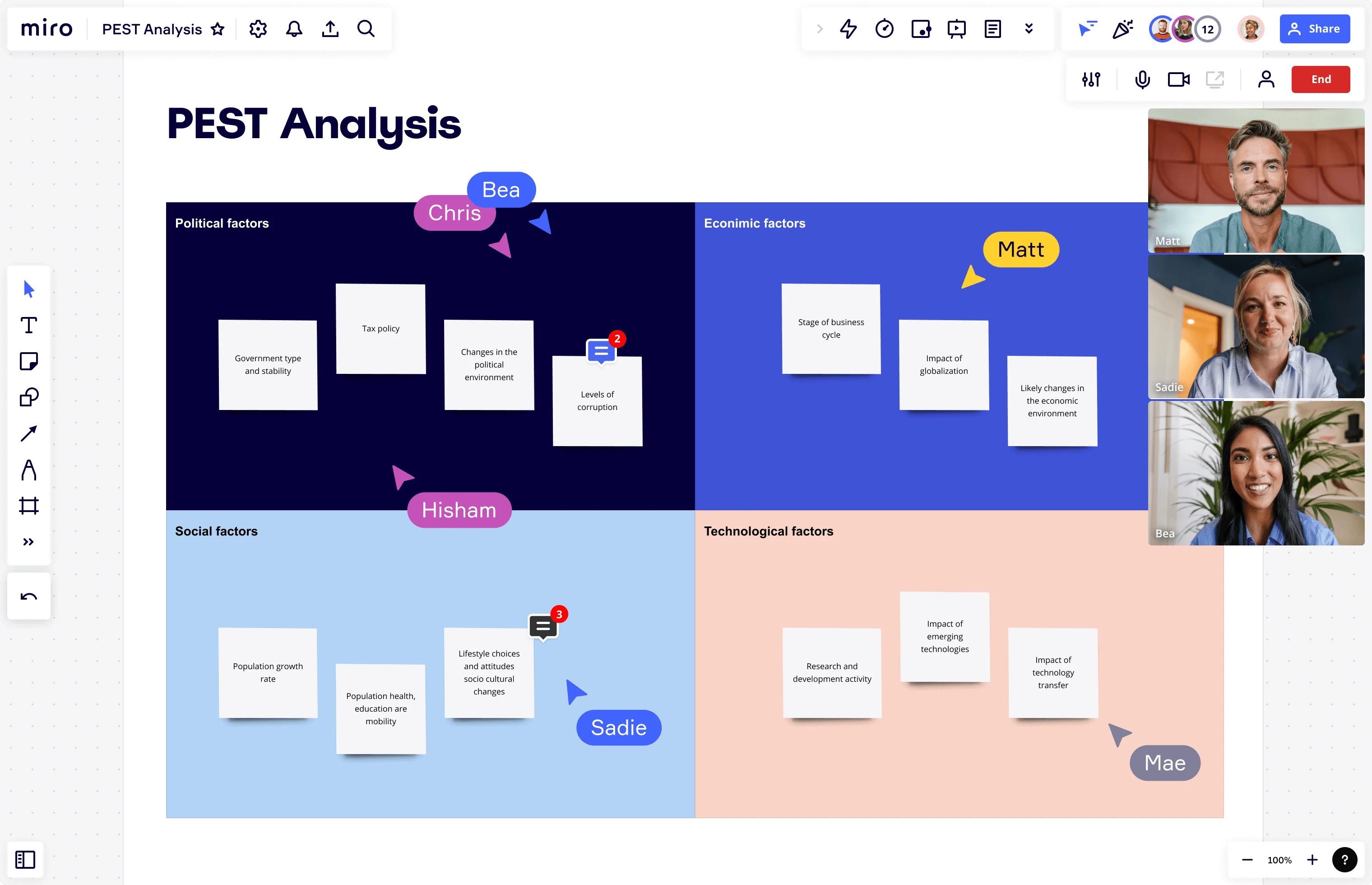

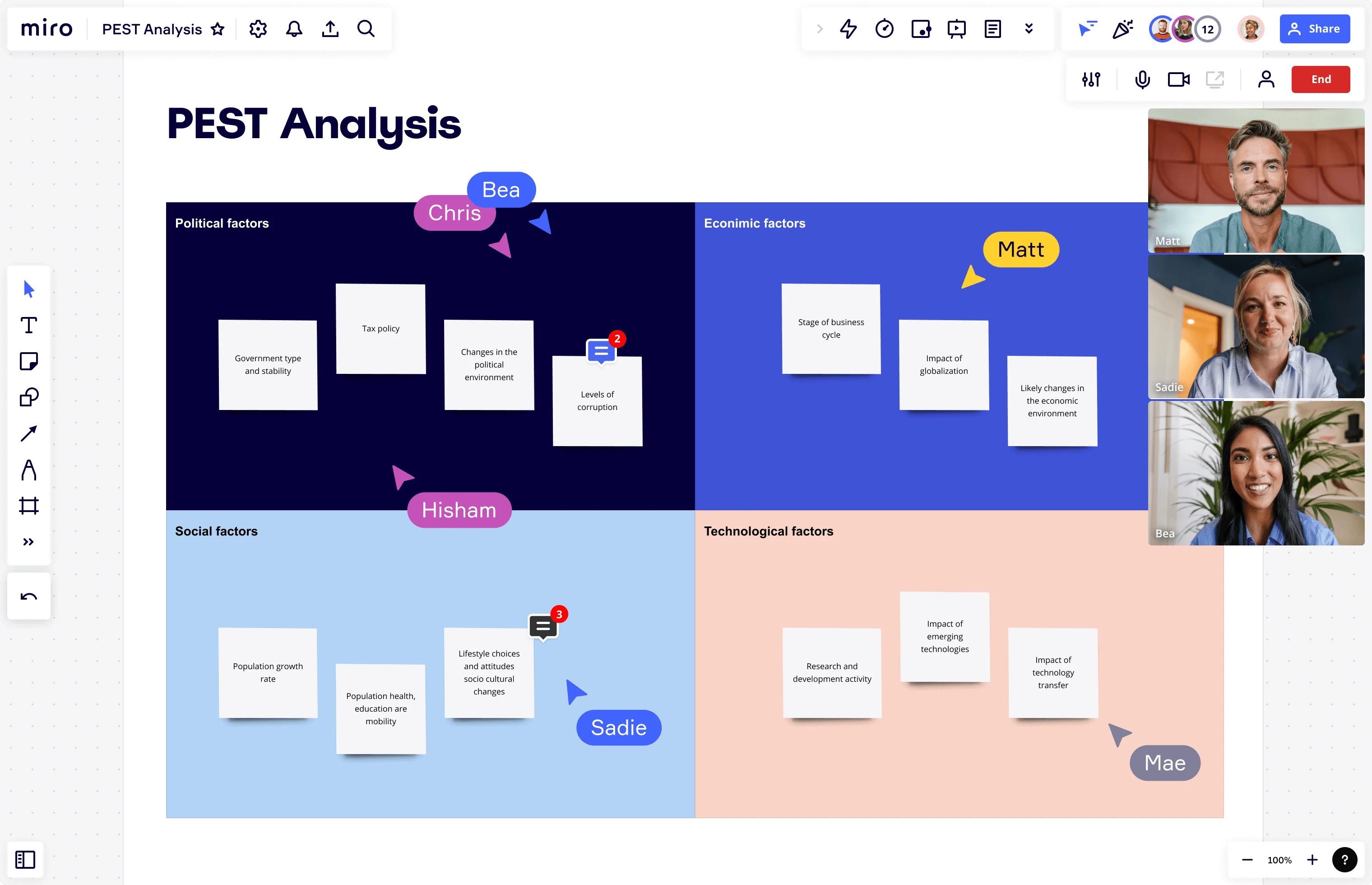

Impact Trees or Diagrams: Visual representations, like impact trees, help map out consequences in an organized manner. They illustrate how one change can trigger multiple effects, giving analysts a bird's eye view of potential repercussions. Especially in sectors with complex operations, such visual aids are indispensable.

Checklists: Though simple, checklists are robust guides. They ensure that analysts cover every facet of potential impacts, from the most apparent to the minutest details. In industries like aviation or healthcare, where overlooking minor elements can have significant repercussions, checklists are crucial.

Surveys and Questionnaires: Direct feedback tools, like surveys, are the voice of stakeholders. They provide raw, firsthand data on how a proposed change might be perceived or impact different groups. This feedback is gold for customer-centric businesses, such as retail or e-commerce.

Simulation Models: Simulation models allow businesses to play out hypothetical scenarios in finance and tech. Companies can forecast outcomes and devise strategies by simulating market changes or tech disruptions.

Challenges in conducting impact analysis

Despite its prowess, Impact Analysis in a business context faces challenges:

Potential biases: Businesses driven by profit motives might sometimes hope for positive analyses. This can create a confirmation bias, where analysts might subconsciously favor data that aligns with desired outcomes. For instance, a retail chain might downplay negative environmental impacts in hopes of green-lighting a new store location.

Forecast uncertainties: The business world is inherently unpredictable. Market shifts, global events, or technological breakthroughs can turn forecasts upside-down. An e-commerce platform might predict a stable year, but an unforeseen global pandemic could boom online sales or disrupt supply chains.

Diverse stakeholder perceptions: Businesses cater to various stakeholders, from shareholders to local communities. Aligning their diverse interests and perceptions is a colossal challenge. A tech startup's decision to relocate might be cheered by investors but lamented by local employees and businesses.

Balancing these challenges requires technical prowess and ethical considerations, ensuring that Impact Analysis remains a tool for informed, holistic decision-making.

The future of impact analysis

With advancements in artificial intelligence and data analytics, the scope and precision of impact analysis are set to improve. Simulations will become more accurate, and real-time data will allow dynamic adjustments. We're moving towards a world where the potential impacts of decisions are more transparent than ever.

Impact analysis is an invaluable tool, guiding entities through the labyrinthine implications of their actions. It ensures that decisions are not taken lightly and that their positive and negative ripples are fully understood.

For professionals across sectors, comprehending impact analysis isn't just beneficial—it's imperative. As change remains the only constant, mastering the art of predicting its effects remains a cornerstone of successful strategy and forward-thinking.